Investors are keen to buy in inexpensive tokens as the market steadily

improves, taking advantage of the opportunities brought about by the approaching bullish trends. But selecting these pennies-worth of tokens requires careful consideration. For that reason, this post selects inexpensive tokens that could increase in value in the cryptocurrency market.The thrill of finding the newest and greatest cryptocurrency, especially if it costs less than a cent, is what attracts investors to tokens like ALGO, ASTR, and FET. These tokens have gained popularity recently because of their reasonable prices and potential for market growth, which has drawn traders in. Meanwhile, Bitcoin has risen 3% in the last week, and analysts predict a longer-term upward trend.

1. Algorand (ALGO)

AlgoKit 2.0 will integrate pure, native Python into its platform, which is welcome news for developers in the Algorand ecosystem. This move aims to empower millions of developers worldwide, including students and AI/ML professionals. With AlgoKit, builders can begin their journey in 10 minutes. Hence, it offers users easy development, testing, and deployment on the Algorand blockchain.

Moreover, Algorand is transitioning from a relay structure to a peer-to-peer (P2P) gossip network. Notably, this is similar to the operational model adopted by Bitcoin and various other crypto networks.

Furthermore, Algo’s shift toward a P2P network is crucial for the Algorand network as it strengthens its resilience and autonomy. Therefore, this positions it for sustained operation independently of potential disruptions. In the market scene, ALGO is currently bearish; however, a greed score of 60 suggests active trade by investors.

By extension, this trading activity indicates that an upward trend is forthcoming. Similarly, Algorand’s performance remains robust, with its position above its 200-day SMA. In addition, it is boasting high liquidity based on its market capitalization.

2. The 1INCH Network

The price of 1-inch Network recovered from losses the previous day after taking a fall below the 200-day EMA on Friday. Over the last two sessions, the price trended down and tested the 200-day EMA.

Furthermore, due to short-term uncertainty, 1INCH’s recent movement has oscillated back and forth. In spite of this, the increase of almost 3% today added to a weekly growth of 3.79%. In addition, 1INCH has recently shown strong performance, rising from October 2023 to mid-January 2024.

But in the previous few weeks, its value dropped dramatically, losing more than 15% of its original amount. Even yet, it continues to grow by 27% during the preceding three months. Additionally, as 1INCH is trading above the 200-day EMA, the long-term picture is still favourable. A trend reversal could be indicated, though, if this indicator breaks below. All things considered, 1INCH’s present tendencies make it a strong choice to think about.

3. AZERO, or Aleph Zero

Ever since Aleph Zero was listed on various marketplaces, it has attracted a lot of interest. AZERO is currently trading on KuCoin, and while the price sentiment is unfavourable, investors’ reaction is shown by a greed index of 60. Moreover, many feel that AZERO’s trading above its 200-day moving average portends the beginning of a bull market.

AZERO’s price, on the other hand, has risen 6.26% intraday to $1.100998, with $2.82 million worth of trades. Additionally, it has a market capitalization of $293.72 million and a market share of 0.02%.

Analysts predict that if AZERO partners with other networks, its price may soar. In light of this, the estimate indicates a maximum price level that will exceed $4.42 by 2024. Additionally, by the same year, Aleph Zero’s average price is predicted to stabilise at about $4.00 in an optimistic scenario for the cryptocurrency market.

4. Astar (ASTR)

Astar was released on the mainnet of Astar Network, a large multi-chain smart contract and Web3 infrastructure platform. The Ethereum community is going to be significantly disrupted by this new Layer 2 scaling option. Polygon’s Chain Development Kit (CDK) powers Astar zKEVM, an L2 compatible with the Ethereum Virtual Machine that operates on zero knowledge.

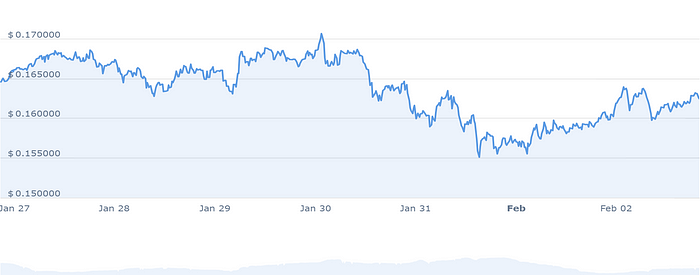

Astar is performing great concurrently and is getting closer to the $0.2200 threshold. This upward trend implies that Astar may reach $0.2200. As a result, traders who intend to make long-term cryptocurrency investments may continue. Furthermore, Astar’s price is above significant moving averages, which is positive for the market.

Furthermore, recent trading sessions demonstrate the dominance of bulls. Astar appears poised to soar further now that it has gotten momentum. The positive perception of buyers in the market is supported by this activity and momentum.

5. Bitcoin Minetrix (BTCMTX)

A novel project by Bitcoin Minetrix lets users stake BTCMTX tokens to receive credits for cloud mining. Decentralising control and offering token holders a safe mining environment are the main goals.

Additionally, the platform’s staking pool has garnered a lot of interest and has amassed a noteworthy stake of more than 400,000 BTCMTX tokens. The promised annual percentage yield (APY) of 103,225% is the outcome of this accumulation. Thus, it suggests that participants have a keen interest.

Notable market traction has been shown by Bitcoin Minetrix during its initial presale round. Additionally, BTCMTX’s continuing presale has raised over $10 million by selling tokens for $$0.0132 apiece.

6. Flow (FLOW)

Despite a bearish sentiment, Flow shows a greed level of 60 on the Fear & Greed Index. Notably, it maintains a stable position above its 200-day simple moving average. Recent performance indicates a positive trend, with 16 green days out of the last 30, reflecting a 53% increase. In addition, Flow boasts high liquidity, which is evident from its market capitalization.

Furthermore, Flow currently leads the NFT Tokens sector by market cap and holds the 34th position in the Layer 1 sector. With strong fundamentals and community support, Flow is poised for growth. Also, collaborations with other networks could propel the FLOW Coin’s price beyond $3.81 by 2024.

If the bullish trend in the crypto market persists, Flow’s average price may stabilize around $3.45 by 2024. Moreover, Flow’s current market trends and community backing positions it for future growth. Therefore, investors should monitor announcements of collaborations, as they could significantly impact the coin’s value.

7. Fetch.ai (FET)

Resilience is being carved out by Fetch.ai. Remarkably, it has recovered from the $0.55 support level, supported by a positive Relative Strength Index (RSI) and a spike in trading volume. These indicators point to a possible quick upward rise towards $1.5.

Additionally, the temporal correlation between the prevailing bearish emotion and the greed level of 60 indicates optimism among investors. Additionally, Fetch.ai outperformed 77% of the top 100 tokens with a 104% increase over the previous year.

FET is presently ranked #50 in the Layer 1 sector and #38 in the Ethereum (ERC20) Tokens category. With a solid market presence, it is ranked #7 in the AI Crypto industry. Within the cryptocurrency space, Fetch.ai presents a good investment opportunity due to its significant liquidity, which may be ascribed to its market cap.

by Shogun Saski, Medium

No comments:

Post a Comment